The importance of remaining invested

After the recent stock market decline – said to be the worst start to a year since 1970 – you may be wondering why you invested in the first place.

With a constant stream of negative headlines feeding the insatiable 24-hour news cycle – it’s understandable if nerves start to set in.

Investing may start to seem like a reckless gamble, and some will be wondering whether it might be best to “cut my losses”.

During these moments (of which there have been many throughout history) it’s worth remembering that, in stark contrast to gambling, the longer you remain invested in a diversified portfolio, the more likely you are to make positive returns.

As this recent analysis by JP Morgan illustrates - in the short-run, the stock market is indeed prone to violent swings – in both directions. But the longer you invest for, the narrower the range of outcomes becomes and the lower the risk of losing money.

This is the reason why financial advisers are so focused on “minimum 5 year investment time horizons” – it is the length of time required to give investors a decent chance, statistically, of making a positive return.

Diversification can also help spread the risk and narrow the range of outcomes.

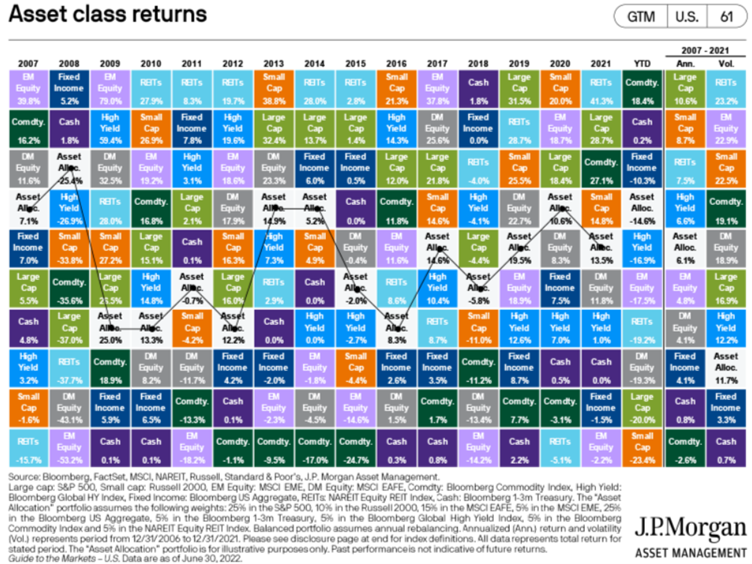

As the chart below demonstrates, trying to predict which asset class (let alone specific stock) will yield the greatest returns each year, is very difficult (and statistically improbable).

Spreading the risk across a well-diversified investment portfolio can help reduce specific risk for a given level of expected return.

No one can predict the future. But during times of economic/political uncertainty, it is important to remember why you invested in the first place, control your emotions, and understand that diversification and remaining invested can help to improve your chances of making a positive return.

Get in touch

If you would like to speak to an independent financial advisor near Bath please contact us. We can work with you to create an investment strategy that will allow you to pursue your financial objectives with confidence.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.