“Why invest?”

As the old saying goes, investing is simple but not easy. We would agree.

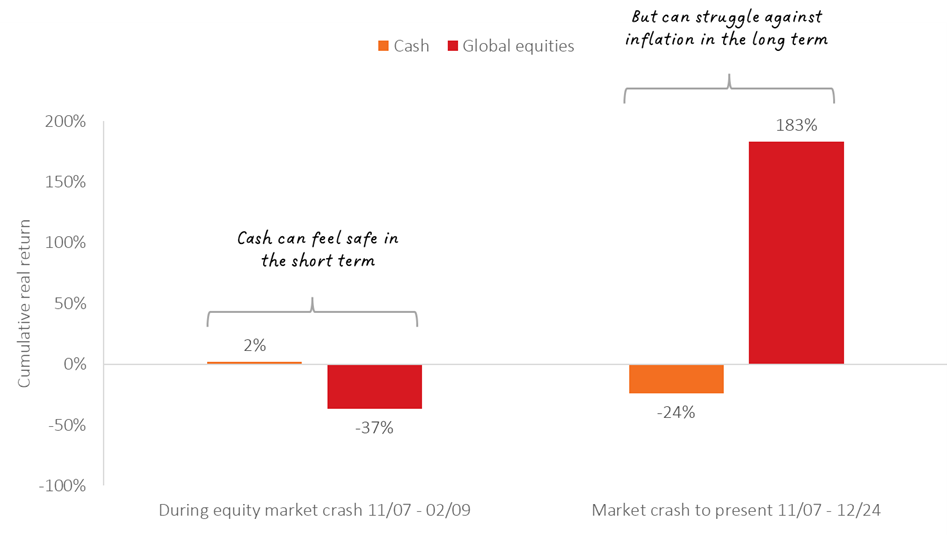

The first hurdle that people face is whether to invest at all. For those who are inexperienced investors, or who have suffered a bad initial foray into markets, it can be hard to step away from the sense of safety that a bank deposit provides. In the short term, cash can feel comfortable, but it has a terrible track record of maintaining or growing purchasing power – i.e. the amount of goods or services your money can buy - over time for investors. For us, that makes it a risky strategy. The chart below demonstrates how cash performed during the Global Financial Crisis (2007-2009) and how it has performed since then, compared to world equities (developed and emerging). Over the whole period, 24% of cash’s purchasing power has been eroded, whilst the purchasing power of ‘higher’ risk equities more than doubled, even when measured from the height of the market before the fall.

Figure 1: Why we need to invest - Playing it ‘safe’ is not going to get you there

Source: Morningstar Direct © All rights reserved (see endnote). Indices: DB SONIA, MSCI ACWI. Adjusted by: UK CPI.

So, investing can be a sensible option, if you have long-term financial goals, as cash is not the answer.

It is simple enough to pick a few shares of well-known global companies to hold in an online brokerage account. It is also simple to avoid this task by engaging a professional investor – such as a stockbroker or fund manager - to manage your money for you. Yet it is not easy to know whether the portfolio you or they build is sensible, the manager you have chosen is worth his or her salt, or that your pool of investments will be able to meet the goals that you are aiming to achieve. It is certainly not easy to stay calm and rational when markets are soaring or in free-fall, as they inevitably will be from time to time.

It is not surprising that many of the new clients who come to us do so with a great sense of unease about their existing investments. This may be due to a bad experience or poor advice in the past, a sense of fear of what might happen in the markets to their hard-earned money, or simply a lingering doubt that how they are invested currently may be less than optimal. In some ways they are the lucky ones, as they have realised that their investment strategy needs fixing, and we can help. Many others are not so fortunate, holding too much cash or taking risks they do not understand in their portfolios, suffering high costs on the investments they own, or chasing last year’s best performing markets and funds, all of which is likely to be detrimental to their wealth. They are also likely to be disappointed by their investment experience, which is more than just a shame. It is unnecessary.

Important notes

This is a purely educational blog to discuss some general investment related issues. It does not in any way constitute investment advice or arranging investments. It is for information purposes only; any information contained within them is the opinion of the authors, which can change without notice. Past financial performance is no guarantee of future results.